Becoming an expert on Medicare takes a lot of time and research! There are many different plans, subtle differences in how they work, and different costs. There’s even more to know when it comes to signing up and using your Medicare benefits.

One of the big questions we get here at Advanced Benefit Solutions is about the difference between Medicare Supplement and Advantage plans. This is an important distinction to make so you can get a plan that fits your needs and your budget.

After reading this blog, you’ll have the answers you’ve been looking for!

Original Medicare Doesn’t Do It All

When you turn 65, you have two different options for Medicare. You can choose Original Medicare, parts A and B, or you can opt for a Medicare Advantage plan.

With Original Medicare, your costs are based on your income and you will likely need to pay a portion of the cost for each service out of pocket. Many regular services are covered, but most people find that they will have out-of-pocket expenses, and those can be difficult to estimate.

It may be surprising to learn that yes, there are gaps in Medicare, i.e., things that you will be responsible to pay for.

That’s why people opt for a Medicare Supplement plan, (also known as Medigap plans), which are sold by private insurance companies. There are ten common supplement plans available to help cover these out of pocket costs.

More About Medicare Supplement (Medigap) Plans

Medicare Supplement plans have letter names from A to N that help pay for deductibles, coinsurance, and copays. What they don’t cover are prescription drugs – you’ll still need to purchase a Medicare Part D plan.

Medicare Supplement plans do not replace Original Medicare; instead, they are secondary insurance meaning that Medicare pays first and your Medigap plan pays second.

Medicare Supplement plans are standardized, meaning you will know exactly what you are purchasing (it’s the same benefit from carrier to carrier) and you don’t need to reapply each year.

Medicare Supplement plans can help you better prepare for the costs you may have if you see many doctors or are hospitalized often. Costs vary much like individual private insurance, so it’s important to work with someone who can diligently look over all the plans available to find the right options for you.

What About Medicare Advantage Plans?

Medicare Advantage, also known as Medicare Part C plans, are only sold by private insurers and function as a replacement of Original Medicare. Medicare Advantage will be your primary insurance if you choose this kind of coverage.

Medicare Advantage plans typically include prescription drugs and some can include dental, vision, and hearing coverage as well. Even though Medicare Advantage functions as a replacement for Original Medicare, you are still required to be enrolled in both Medicare Part A and B.

While Medicare Advantage plans appear to cover more than Original Medicare, your options for care may be limited to certain providers and hospitals.

Instead of federal mandates, the biggest difference here is that your private insurance carrier is the one managing the usage of your care. You may have to get referrals and authorizations to see certain providers or have a procedure.

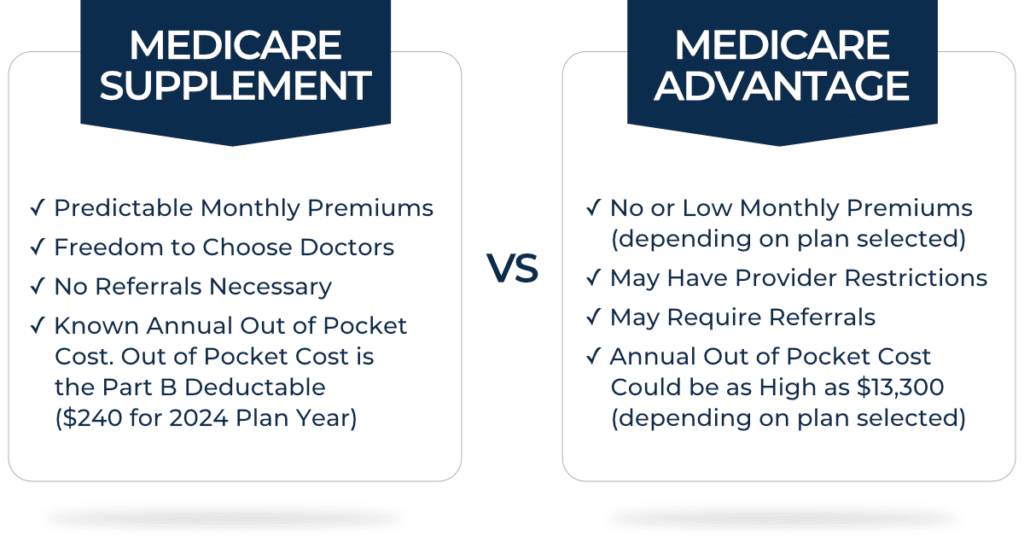

Medicare Supplement vs Medicare Advantage Plans

Important to Know

If you choose to change your standard Medicare Supplement plan and purchase a Medicare Advantage plan during the Annual Enrollment Period (From October 15th through December 7th), you get one year to see if a Medicare Advantage plan is right for you.

If you’re dissatisfied before the year is over, you can switch back to Original Medicare and buy a Medicare Supplement Insurance plan (also known as a Medigap plan) without medical underwriting. After one year, your application for the Medicare Standard Supplement plan will have to have underwritten approval.

Remember, Original Medicare with a supplement means you can see any doctor that takes Medicare. Not all hospitals accept Advantage plans, and your Advantage benefits may change every year. While some Advantage plans have a $0 premium, you will still pay the Part B premium to Medicare and you will pay deductibles, copays, and coinsurance.

Which Plan is Right for You?

It depends on where you live and how much you anticipate using your plan. Our specialized Medicare experts can help you navigate the world of Medicare Advantage and Medicare Supplement plans.

We welcome your questions and would enjoy the opportunity to help you find the right Medicare plan to fit your needs.

Reach out to us by emailing health@abenefitsolutions.com or call us today to get started