Understanding Your Health Insurance Options

Finding the Right Balance Isn’t Easy — And You Shouldn’t Have to Do It Alone

For small business owners, offering health insurance isn’t just about picking a plan and calling it a day. It’s a complex balancing act between cost, coverage, compliance, and administration—and getting just one of those wrong can lead to unhappy employees or expensive mistakes.

- Cost: You want a solution that fits your budget, but rising premiums and hidden fees, or worse, wasting money on a benefits package your employees either don’t use or don’t understand how to use, can make affordability hard to gauge.

- Coverage: Employees want options, especially if you’re hiring across age groups or life stages—but more choices often mean higher costs.

- Compliance: Even if you’re under 50 employees and not subject to the ACA employer mandate, you still have to navigate IRS rules, state regulations, and annual reporting requirements.

- Administration: Enrollment paperwork, plan comparisons, employee questions, billing—these tasks take time away from running your business.

Trying to tackle all of this on your own, or relying on generic online tools or your payroll provider, can leave you vulnerable to missteps—and that’s where a partner like Advanced Benefit Solutions makes all the difference. We don’t just offer plans—we offer peace of mind, with tailored advice and hands-on support that simplifies the process and protects your business.

Types of Health Insurance Plans for Small Businesses

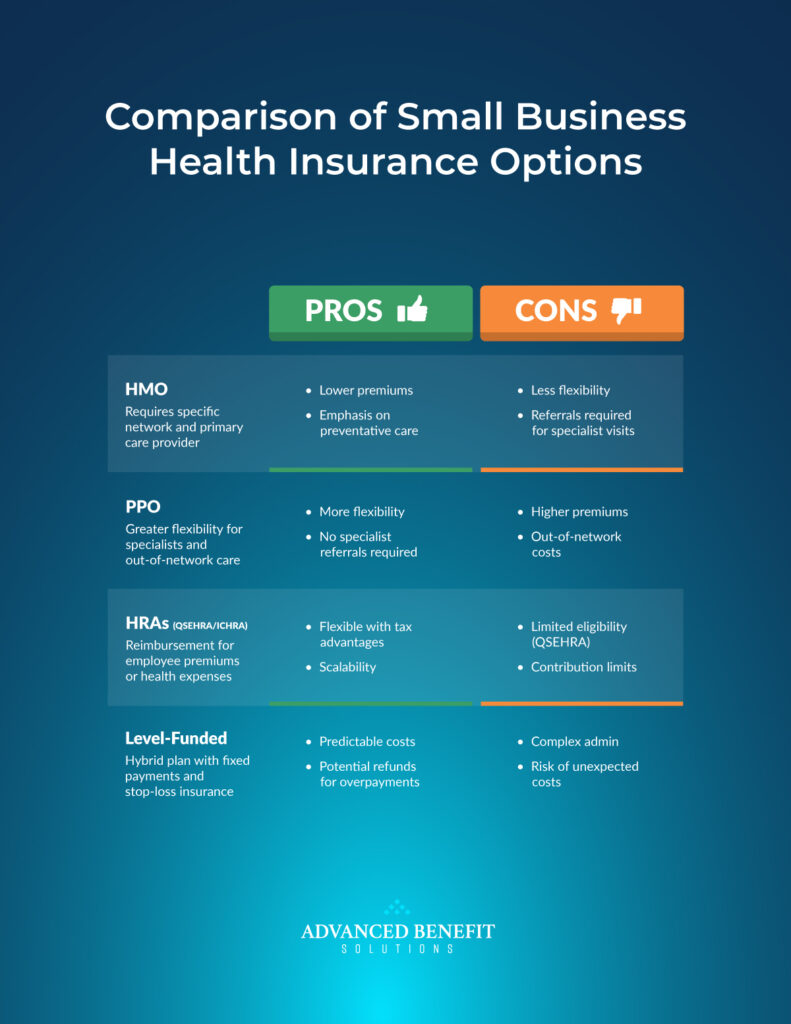

Here’s a breakdown of the primary options available to Texas small businesses:

1. Traditional Group Health Plans (HMO, PPO)

This is what most people think of when they hear “health insurance.” PPO and HMO plans have been around for a long time, and most people choose a plan like this because it is familiar.

- Health Maintenance Organization (HMO): Offers lower premiums and emphasizes preventive care. Employees must use a specific network and select a primary care provider.

- Preferred Provider Organization (PPO): Provides greater flexibility to see specialists without referrals and allows for out-of-network care, albeit at higher costs.

Pros:

- Structured plans with predictable costs

- Comprehensive coverage options (often includes things like preventive care, hospital stays, specialists, prescriptions, etc.) and you may have the option to bundle vision or dental.

Cons:

- Less flexibility in provider choice (especially with HMOs)

- Potentially higher premiums (especially with PPOs)

2. Health Reimbursement Arrangements (HRAs)

- Qualified Small Employer HRA (QSEHRA): Designed for businesses with fewer than 50 employees, allowing tax-free reimbursements for employees’ qualifying medical expenses, including individual health insurance premiums.

- Individual Coverage HRA (ICHRA): Offers more flexibility, enabling employers to reimburse employees for individual health insurance premiums and medical expenses, with the ability to vary contributions among different classes of employees.

Pros:

- Cost control and budget predictability

- Flexibility for employees to choose their own plans

Cons:

- Employees must secure their own individual health insurance plans

- Requires clear communication to ensure employee understanding

3. Level-Funded Plans

A level-funded plan is a popular option for small businesses that want more control over their health care costs without taking on the full risk of self-funding. These plans combine the structure of traditional insurance with the potential savings of a self-funded model.

With level funding, your business pays a predictable monthly amount that covers:

- Your estimated claims costs

- Administrative fees

- Stop-loss insurance (to protect against large or unexpected claims)

At the end of the year, if claims are lower than expected, you may get a refund—a major advantage over traditional fully insured plans, where unused premiums are kept by the insurance company.

Pros:

- Predictable monthly payments

- Potential for year-end savings

- Greater transparency into how your healthcare dollars are spent

Cons:

- May require more plan setup and education than fully insured plans

- Less flexibility than a fully self-funded model (but safer for smaller employers)

Key Considerations for Texas Small Businesses

- Employee Needs: Assess the demographics and health care needs of your workforce to choose a plan that offers appropriate coverage.

- Budget Constraints: Determine what your business can afford in terms of premiums and out-of-pocket costs.

- Regulatory Compliance: Ensure that the chosen plan complies with both federal and Texas state regulations.

- Administrative Capacity: Consider the resources available to manage the plan, including enrollment, claims processing, and employee communication.

If this sounds like a lot to do for a small business, partner with our team at Advanced Benefit Solutions. We help you in each one of these areas – from assessing your employee needs, to handling all the compliance and paperwork, and meeting YOUR needs as a business – both for your budget and your efficiency in operations.

Why Partner with Advanced Benefit Solutions?

- Tailoring health insurance solutions to fit small business budgets and employee needs

- Navigating the complexities of various plan options and regulatory requirements

- Providing ongoing support to ensure smooth plan administration and employee satisfaction

Contact Us

Ready to explore health insurance options for your Texas small business? Reach out at abenefitsolutions.com/contact or call us at (512) 291-9300 to schedule a consultation.