We are making our way through 2024 and many are asking if California has made any progress on a potential tax to support a long-term care fund for residents of the state (California LTC Tax).

Currently, here is what we know:

- The actuarial assessment was completed and submitted by the firm Oliver Wyman.

- To date, California has not submitted a bill.

- Likely, the state will not pass something in 2024. With the pending elections and session ending, there is not enough time.

California LTC Insurance Task Force AB 567

CA Insurance Department

Legislature established the AB 567 Task Force to recommend options for designing and implementing a public long-term care (LTC) insurance program for California.

Following receipt of the Actuarial Report, the Legislature may or may not choose to proceed with legislation to establish a public LTC program. If the Legislature does proceed with such legislation, it may choose to adopt some, all, or none of the Task Force’s recommendations. As of right now, the Legislature has not made any decisions about a public LTC program, no payroll tax is being implemented, and there is no current “opt out” date.

Information stated above is from AB 567 Clarifications.

Key Dates for California LTC Tax Research

December 2022, Task Force finalized Feasibility Report, in which 5 plan designs were proposed.

December 2023, Oliver Wyman completed analysis of the 5 plan designs and submitted to CA Legislature (outlined below).

Resources

- Oliver Wyman Feasibility Report FAQ

- Actuarial Analysis by Oliver Wyman

- AB 567 Actuarial Analysis and Next Steps

- AB 567 Clarifications

The information provided above regarding the California LTC Tax was provided by LTC Solutions and captures a snapshot in time of California’s legislative efforts as of 6/2024 and is subject to changes.

LTC Momentum Continues to Rise

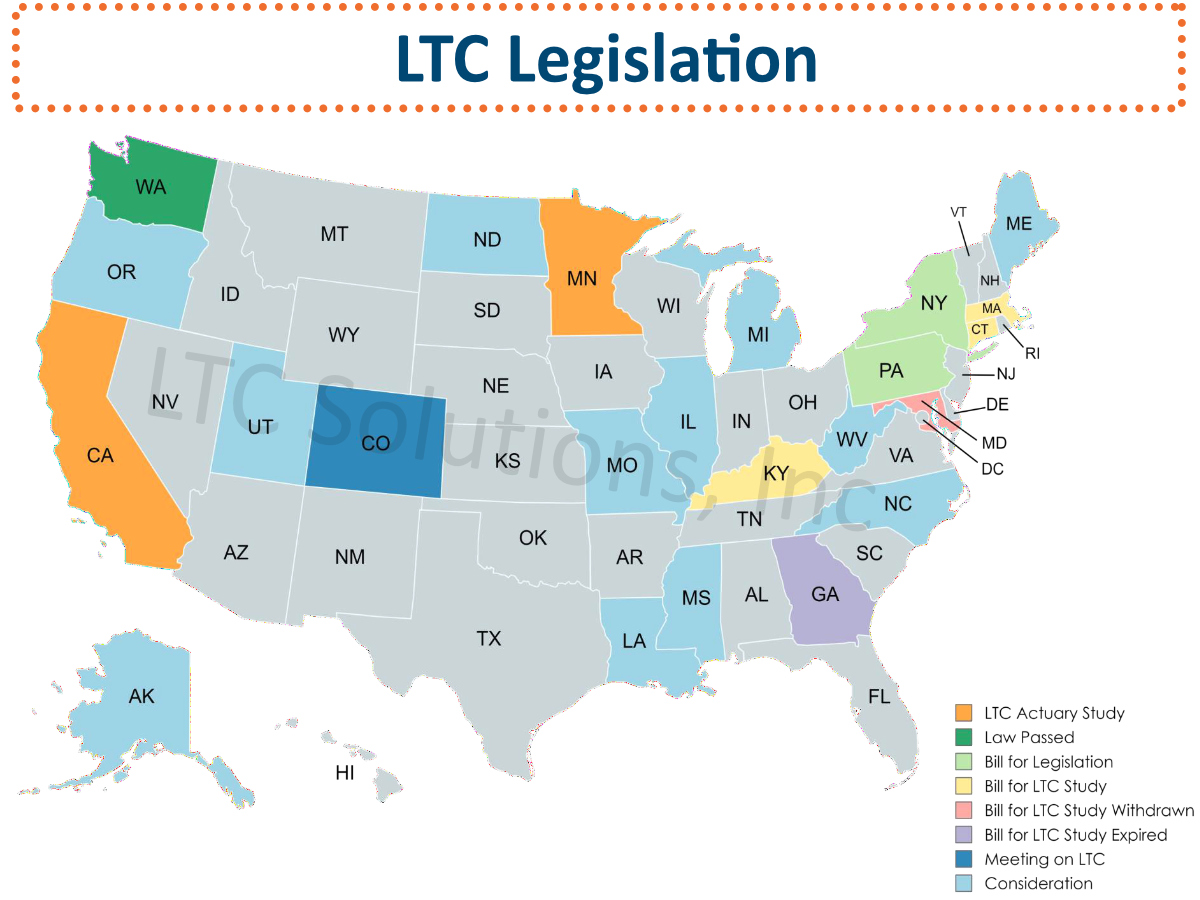

Based on this, many feel the California LTC tax conversation will pick up steam again in 2025. There have not been any confirmations of if/when a tax could be implemented at this time though. However, with so many states either evaluating the risk, proposing bills, or implementing a tax, the momentum across the country continues to rise (see the above heatmap highlighting activity in certain states).

There is still debate on opt-out options, but many feel there will be one, if a tax gets implemented. Even though they have not been defined, many states are discussing it. New York even has it in their proposal NY State Senate Bill 2023-S8462 (nysenate.gov).

The same theme applies as it did a year ago with many experts on this topic. If long-term care planning is of importance to you and your family, the potential tax is only heightening awareness of the risk to a financial plan.

Advisors, We are Here to Help

We continue to encourage clients to speak with their financial advisors on this topic to understand the financial impact of a long-term care event. Plus, looking at options to mitigate that risk through insurance.

The landscape is continuing to change and we want to help your clients make the best decision possible. Call us today at (800) 291-2009 or send us an email at info@abenefitsolutions.com

As a reminder, this information is a snapshot in time and legislation is everchanging. It is also not intended to give tax or legal advice.